Trans-IoT is the No.1 UBI solution vendor for insurance companies,

we have more than 42 types of data models and algorithms, ten billion of driving data per year.

Developing the best pricing model for insurance companies through our data and AI algorithm.

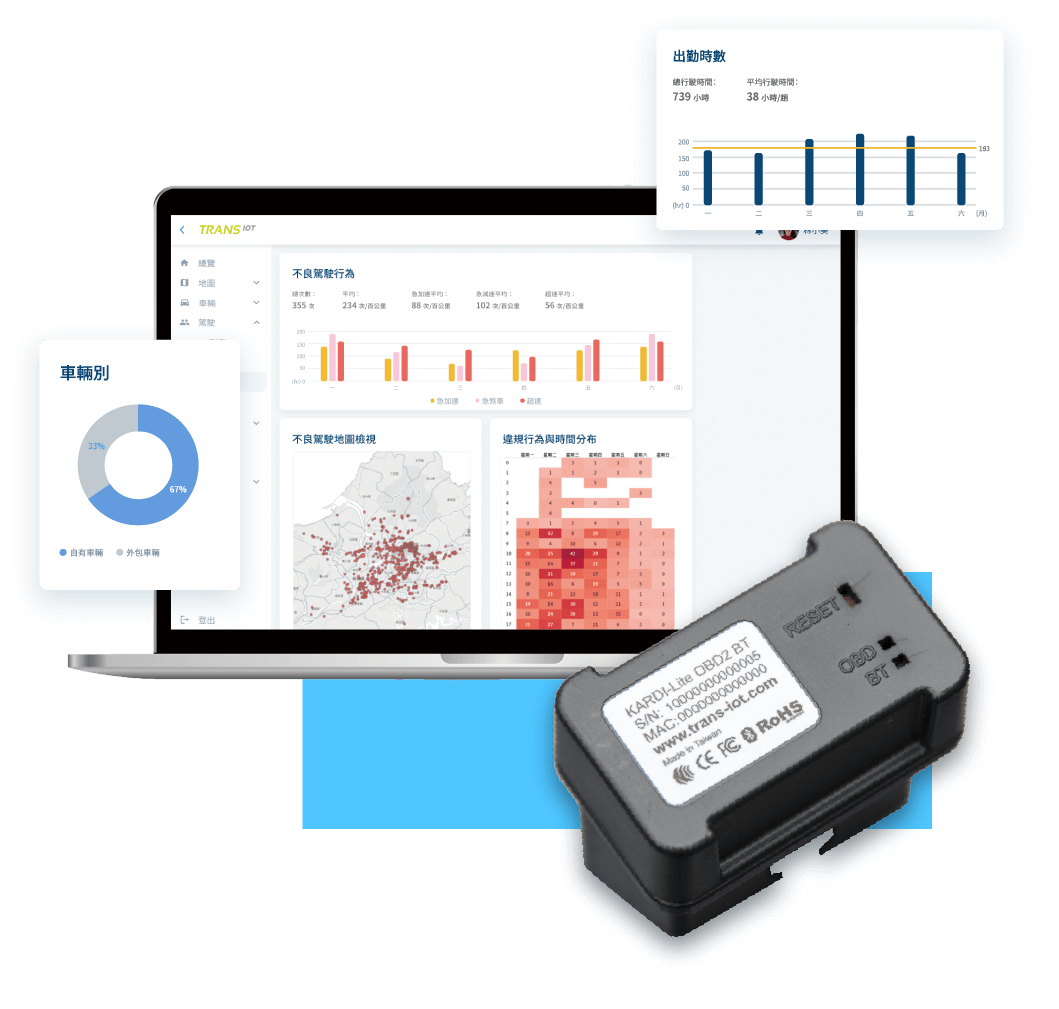

Unique factors include driving mileage, driving hours, rapid acceleration, hard braking, speeding, speed changes and so on, providing a precise premium pricing model according to individual driving behavior.

Driving data such as rapid acceleration, hard braking, idling, speeding, speed changes, driving mileage and hours, will be presented in visualized charts and diagrams.

Optimized profit model, pricing factors suggestion model, premium discount rates calculation, helping insurance company to reduce expenses, and increase customer retention and loyalty.

Preventing insurance frauds and data leakage, all driving behavior and data will be uploaded to the blockchain, ensuring information credibility.

MSIG Mingtai Insurance uses Trans-IoT's KARDI 4G Real-time dashcam, equipped with precise map data, machine vision, and machine learning technology. Reducing labor costs in claim settlements and investigations, insurance frauds, and time costs, significantly increase insurance profits.